Students needn’t worry about taxes because of COVID-19, experts say

Despite more paperwork, tax experts say tax returns should be similar to previous years

By Maxine Ellis

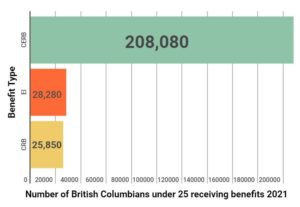

Despite many students having taken advantage of CERB, EI and other government benefits this past year, experts say students can expect a similar tax return in 2021.

The COVID-19 pandemic had created many different financial challenges for students in the past year. Many people were laid off and took advantage of CERB and EI payments. Some students believe that these allowances will make for an even more complicated and stressful tax season.

According to the Canadian Revenue Agency website, those who applied for CERB will have each cheque taxed as if it were their regular monthly income, so most students can expect to owe a similar amount to the one they owed the previous year. The key will be to make the most of online resources and allowable deductions.

Do-it-yourself taxes

One of the most efficient tools for students during tax season is TurboTax, according to Vikas Darmaraj, a recent business graduate from Simon Fraser University.

“It’s pretty idiot-proof. They can integrate a bunch of information from the CRA website,” Darmaraj said. “You can import a bunch of information and it’s already pre-filled out.”

Students can obtain a T22 form from their school, which outlines exactly how much of their school expenses they can deduct from their total income.

Chantelle Hechanova has been working toward getting her finance licence while shadowing Darmaraj during his financial education sessions.

“Make sure you’re mindful and keep track of things throughout the year, what are big things you will be taxed on and get deducted off. School is a big one of course,” Hechanova said.

For students who are working jobs and are taking classes from home, one benefit is the new work-from-home tax credit, which allows Canadians working from home to deduct up to $400 from their income for employment expenses.

SOURCE: Government of Canada

Free help with filing is available

Marcella Baratta Ribeiro from the Langara Accounting Club said that Langara students can reach out to the club members, as well through social media, for help with their taxes. Ribeiro also suggested students use the free SimpleTax program to file their taxes and emphasizes the importance of being organized before tax season comes around.

“One thing that is key for tax filing is organization,” Ribeiro said.

“Consolidate all your slips or documents in the same place during the year like medical expenses and employment slips. The main thing is to have all your documents together ahead of tax season so you can file them on time.”

For many students filing taxes on their own for the first time, this is an excellent opportunity to become more financially literate, said Darmaraj.

“If I gave you $1,000 and you had to pay $500 away in taxes or you [could] pay $400 in taxes, which one would you choose?” Darmaraj said.

“Essentially the government has created vehicles for us that we can use to acquire tax efficient growth with our money. We just don’t have the education to know what those vehicles are because our schooling system doesn’t teach it to us.”

Sarah Fleming is a second-year Langara photography student who has her parents help her file her taxes. She said she has been thinking of running her own business one day.

“I think it would be useful as a small business owner to learn how I have to file my taxes when I start making enough income [to create a small business],” Fleming said. “It would be cool if there were free classes or videos on how to apply for those things.”

Watch Marcella Baratta Ribeiro talk about how to file taxes below:

Comments are closed.