Students on their phones at Langara Students' Union. Young people are taking advantage of money-saving apps. Clarissa Kurniawan

Students on their phones at Langara Students' Union. Young people are taking advantage of money-saving apps. Clarissa Kurniawan

Students face financial anxiety amidst uptick in money apps

The pandemic leaves young people with a sense of financial insecurity

By Clarissa Kurniawan

This story has been updated to include perspectives on students and financial anxiety.

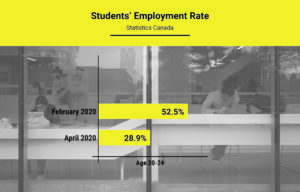

With young adults across Canada facing the highest unemployment rates of any age group during the pandemic, many students are experiencing financial anxiety.

Finance apps are replacing cat ears on Zoom as a new pandemic-trend, as fears of financial insecurity settle in.

Financial anxiety

A 2020 survey by the Organization for Economic Co-operation and Development found that 60 per cent of young people in participating countries are concerned about their economic well-being.

In Canada, young adults faced higher unemployment rates than any other age group during 2020-21, according to a recent report from the B.C. Centre for Disease Control.

Jane Tran, who will be studying graphic design at Langara in the spring, had anxiety about her finances during the pandemic.

“Thinking of everyone going through the same thing, it brings a lot of comforts.” Tran said.“There’s that feeling that we are going through the struggle together. It makes you less lonely.”

Younger generation and mobile tools

In the U.S., according to a report from Global Wireless Solutions, a company that analyzes mobile consumer data, young people increased their hours spent on financial apps by 102 per cent, the highest of any age category.

“Every generation increased usage of finance apps, but Gen Z lead the charge,” the report said.

The finance app market includes investment apps like Wealthsimple, budgeting apps like Mint, and apps like Student Price Card that provides student discounts for over 450 retail brands across Canada.

Many students turned to financial online tools during this time. Canadian use of mobile banking apps increased by 40 per cent in 2020, as measured by Sensor Tower, an America mobile metrics-tracking company.

Caitlin Sklad, assistant branch manager at Royal Bank of Canada, said she’s seen a significant rise in younger people opening up direct investing accounts since the start of the pandemic.

“There’s a lot of things that friends were telling other friends to do,” she said.

Online investment tools like direct investing allow users to trade, invest in a retirement plan and access other choices through their phones.

Brenda St Louis on hacks and resources for students

Brenda St Louis, a Vancouver-based financial therapist and money coach, warned students to be careful.

“Most students will take more risks than someone in the workforce sometimes. You want to understand what you’re doing before you do it,” she said, adding that understanding how money works can also help with financial anxiety.

A new conversation about money

Podcasts and social media sites have allowed students to share and gain financial advice.

Jessica Moorhouse, an Ontario-based financial educator and host of the More Money Podcast, said the pandemic caused more young people to share online about their financial personal opinions.

“The more we talk about it, the better we all [will] be. If everyone has a higher level of financial literacy, the entire society would benefit from it. Everyone can learn and apply this stuff. It just takes time and patience,” said Moorhouse.

*Statistics Canada

Comments are closed.